Parts A and B

Medicare Part A provides hospitalization coverage. Part B provides medical coverage for doctor visits and check-ups. Together, these parts make up what’s known as the Original Medicare plan. It may also be called “traditional” or “basic” Medicare.

We like to think of Part A as your room and board for inpatient hospital stays. It covers your stay in a medical facility and the related services while you’re there.

Most people don’t have to pay a premium for Part A because they paid Medicare taxes while working for at least 10 years in the United States. If you didn’t work or pay taxes but your spouse did, you may still qualify for Part A benefits.

If you’ve worked and paid FICA taxes for at least 10 years (40 quarters) in the U.S., you pay no premium for Part A. Some folks will pay a premium depending on their income.

You might have to pay copays or a deductible for any covered services, although you can apply for help if needed. In addition to a $1,484 deductible for each benefit period, you’ll be responsible for other costs.

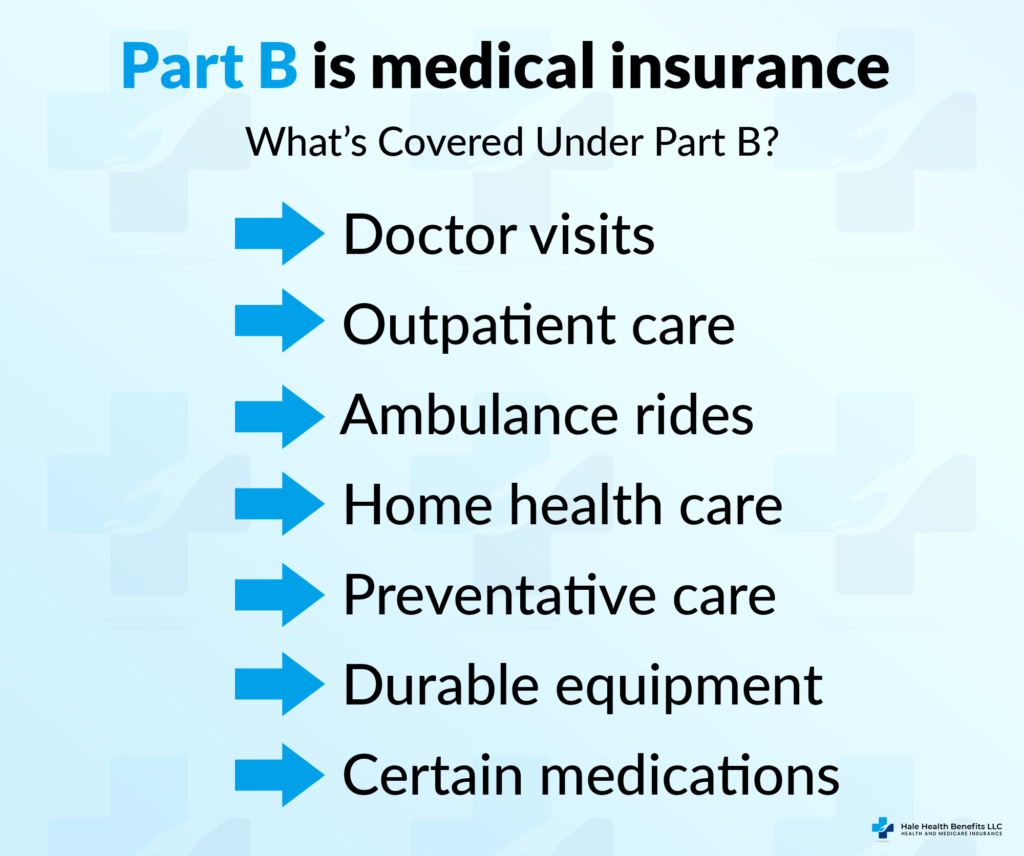

Medicare Part B covers medically necessary services or supplies that are required to diagnose or treat a health condition. It also covers preventative services that help detect and prevent illnesses.

Part B has a deductible, and you’ll owe this amount before getting access to benefits. After meeting your deductible, you’ll pay 20% for most healthcare services. If you need extensive care, it can add up quickly because there’s no annual out-of-pocket maximum.

In addition, there are factors that dictate your Part B premium, such as your income level and when your coverage begins. Most people pay the standard monthly premium.

If you have a health plan on the individual market (also known as Obamacare), it’s smart to enroll in Medicare during your Initial Enrollment Period. If you’re going to be choosing Medicare as your primary insurance, we typically recommend enrolling yourself into Parts A and B — three months before your 65th birthday.

Original Medicare has no maximum out-of-pocket limit and doesn’t provide benefits for the following:

- Dentures

- Hearing aids

- Plastic surgery

- Long-term care

- Healthcare outside the country

It also has limited vision coverage.

So if you don’t have something besides Parts A and B, you’ll be taking a huge financial risk.

What can be confusing is that some people get Part A automatically while other people must enroll themselves. It typically depends on whether you’re getting Social Security benefits.

If you aren’t getting benefits from Social Security or the Railroad Retirement Board (RRB) at least four months before your 65th birthday, you’ll need to sign up with Social Security to get Parts A and B. You can do this online, in-person at your local Social Security office, or call 1-800-772-1213 (TTY: 1-800-325-0778).

Important note: If you don’t qualify for premium-free Part A, you will need to enroll in Part B to get Part A coverage.

There are two ways to get more healthcare coverage:

Option 1

-Stay on Original Medicare and enroll in a Medicare Supplement (Medigap plan)

-You can also add a Part D plan for prescription drugs

Option 2

-Enroll in a Medicare Advantage plan (Part C)

No matter which direction you feel is best, our agents can help you! We assist our clients in Idaho, making sure they find the plan(s) that best suit their needs and shop each year, if necessary.

To learn more about your Medicare plan options, please keep browsing our website.