Medicare Supplements

People who are on Medicare and want to fill gaps in their coverage can decide to buy a supplemental insurance policy (Medigap plan) in addition to Original Medicare. If you’re interested in joining a plan, keep reading to get more information.

Medicare Supplements may help pay for Medicare copayments, coinsurances, and deductibles. Depending on your location and when you become eligible for Medicare, you may have as many as 10 plans to choose from: A, B, C, D, F, G, K, L, M, and N. Be careful not to confuse these plan letters with the Parts of Medicare.

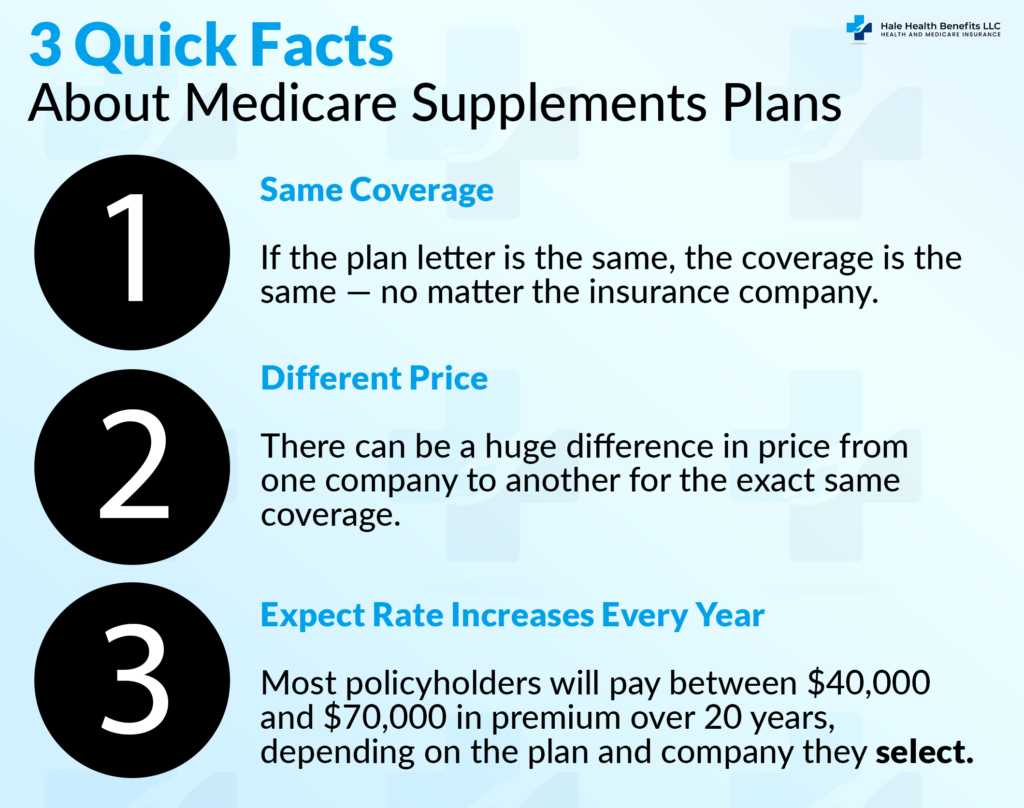

Every lettered Medicare Supplement offers a different group of benefits. However, all plans with the same letter are required to offer the same benefits, no matter which company you purchase it from.

Premiums vary depending on your age, location, the type of plan you pick, and the company you get it from.

Medicare Supplement Insurance companies set their premiums in one of these ways:

- Community-rated: Your premium is the same whether you purchase a policy at age 65 or 75. Your rates may go up, but not because of age.

- Issue-age-rated: Your premium is based on your age when the company first issues you a policy. Inflation may cause rates to increase, but not your age.

- Attained-age-rated: Your rate is based on your current age when you get the policy. It will continue to increase as you age.

🧳 Take Your Coverage with You

Like Original Medicare, your Medicare Supplement plan covers you anywhere in America. This means you can visit family and friends anywhere you want.

🏥 Freedom to Choose Doctors and Hospitals

With Medicare Supplement Insurance, you get to keep your doctors and hospitals. Any medical provider that accepts Medicare patients will accept your Medicare Supplement plan. You won’t have to worry about network restrictions or getting referrals to see specialists!

🌎 Travel the World

Most plans cover healthcare even when you’re traveling outside the country. Plan limits will apply.

The benefit is subject to a $250 deductible, 20% coinsurance, and a lifetime maximum of $50,000.

📅 Coverage Is Renewable

The insurance company cannot cancel your policy. It’ll be renewed each year if you keep paying your premiums on time.

Medicare Supplements do not cover the cost of:

- Eyeglasses

- Hearing aids

- Long-term care

- Prescription drugs

- Private-duty nursing

- Dental or vision care

Consider adding a separate prescription drug plan to lower your costs when you pick up your meds from the pharmacy.

Your Medigap open enrollment period starts when you turn 65 years young or when you first sign up for Medicare Part B. This 6-month period is the best time to buy a plan because you’ll get the lowest available price and companies can’t turn you down for having a pre-existing medical condition.

After this enrollment period ends, you can still apply but the insurance company may use medical underwriting. You could also be denied coverage.

For more information about Medicare Supplement Insurance, please fill out our contact form. A licensed agent will be in touch with you soon!