Medicare Supplement Plans

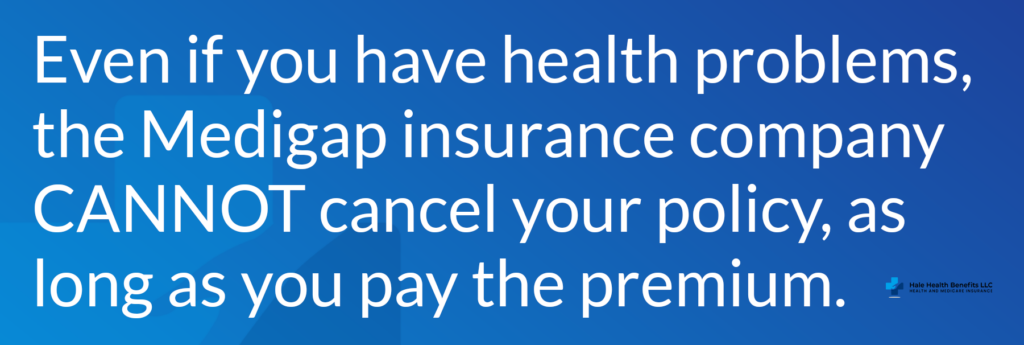

Medicare Supplement plans are health insurance policies that offer standardized benefits to go along with Original Medicare. Also called Medigap plans, they’re sold by private insurance companies and are meant to cover your deductibles, coinsurance, and copays. If you have a Medigap plan in Idaho, it pays part or all of certain remaining costs after Parts A and B pay first.

The most commonly purchased plans are F, G, and N. With a Plan F or Plan G policy, you can basically eliminate any out-of-pocket expenses for your healthcare, provided Medicare pays the claim. For many seniors, knowing that they’ll have very little in terms of out of pocket costs is extremely appealing.

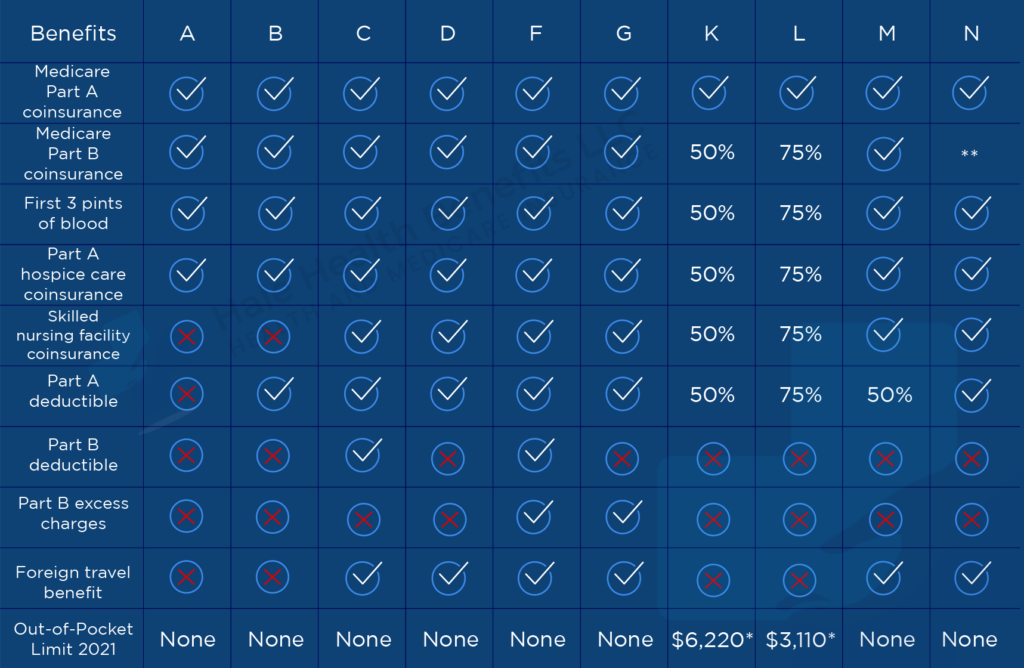

Medicare Supplements (Medigap Plans) Chart

Where you see a checkmark, that means the Medigap plan covers 100% of what Medicare does not.

*Important Note: Plans C and F are only available if you were eligible for Medicare Part A before January 1, 2020. New Medicare enrollees can instead shop rates for Plans G and N, which offer great sets of benefits.

Individuals who have a Medicare Advantage plan can apply for a Medicare Supplement plan but must leave the Advantage plan before the supplement policy begins.

Medicare Supplement Insurance plans only cover one person. If your spouse is seeking this coverage, he or she must buy a separate policy.

You can purchase a policy from any Medigap insurance company that’s licensed in your state to sell you one. When you buy one, you’ll pay a monthly premium to the private insurer in addition to the monthly Part B premium that’s paid to Medicare.

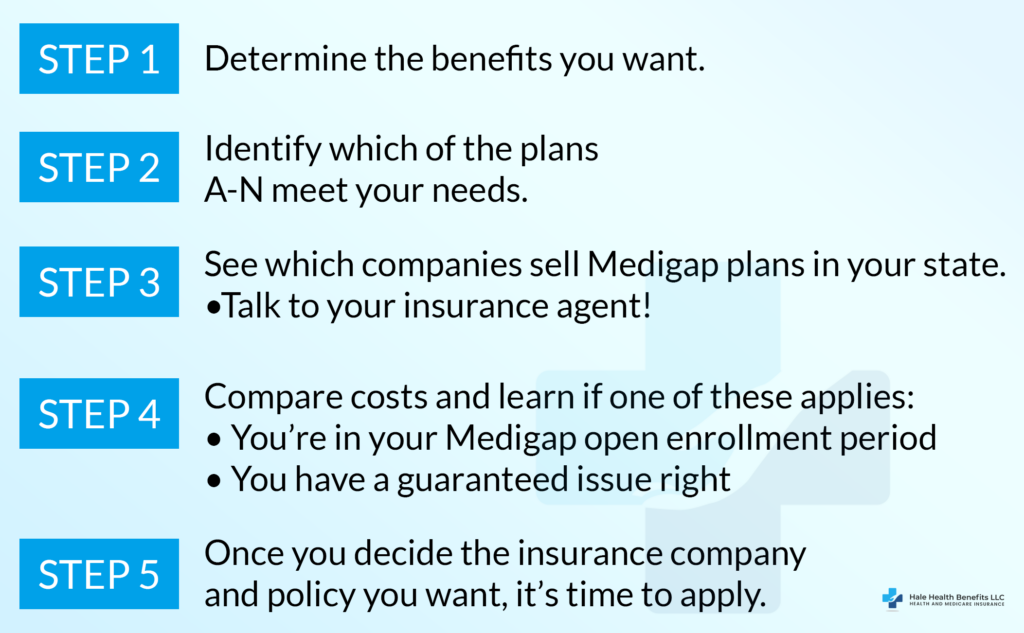

It can be very confusing to understand the different Medicare Supplement plans and determine which plan best suits your needs. Choosing the wrong plan can be a crucial mistake. The Medicare pros at Hale Health Benefits are friendly, knowledgeable, and ready to guide you through the process. Have questions? Need some advice? Contact a specialist today!