Medicare Part D

Have you ever gone to the doctor and received a prescription to get it filled and were shocked by how much it costs? That happens to just about everyone.

Medicare Part D refers to separate prescription plans that help you save money on your medication. It began in 2006.

While prescription drug plans are regulated and subsidized by the government, they’re offered by private insurance companies. Unless you qualify for a subsidy, you’ll pay premiums for the plan, and depending on your plan, you may be responsible for copayments, coinsurances, and deductibles for the medications you need.

You can have Part D as a stand-alone plan with Original Medicare (Parts A and B) or combined in a Medicare Advantage (Part C) plan. Whichever option you choose, it’s important that you have Part D coverage to avoid a permanent late enrollment penalty.

The formulary (list of covered drugs) on each plan may be different. When choosing a prescription drug plan, make sure that your preferred pharmacy is in-network and all your medications are on the formulary. Your insurance agent can help you check this.

If you have Part A or both A and B, you can add Part D coverage during select times of the year, called enrollment periods.

You also have the chance to join, drop, or switch to a new prescription drug plan during the fall Annual Enrollment Period. It’s October 15 through December 7, and if you make a change, your new coverage will start on January 1.

No, it is optional, however, Original Medicare doesn’t cover prescription drugs.

Even if you’re not taking any medications right now, chances are that you’ll need to take some 10 years from now. Not signing up for a Part D plan when you’re first eligible may result in a lifetime penalty (added onto your plan premium), which nobody wants to pay! We’re committed to helping you avoid this costly penalty.

If you’re actively working at age 65 for a large employer (over 20 employees) and have group insurance, you can delay enrollment in Part D until you retire. You won’t pay a penalty for doing this, as long as your employer coverage is “creditable”.

When you retire and that coverage no longer applies, you’ll be granted a Special Enrollment Period to sign up.

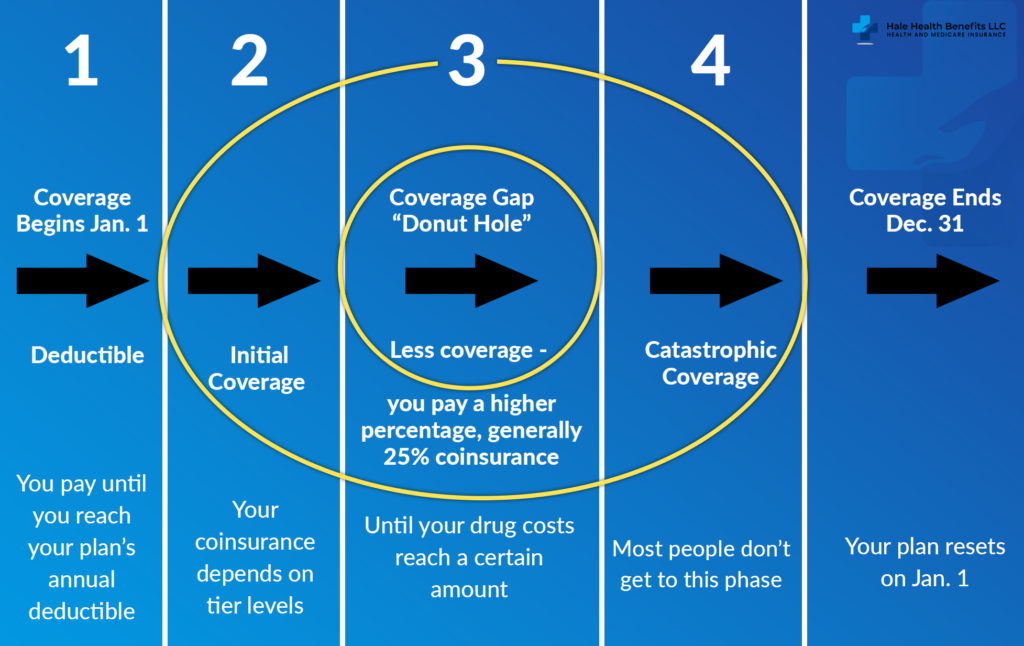

There are four payment stages for Medicare prescription drug plans. Your out-of-pocket costs will depend on which coverage phase you’re in.

The Donut Hole is the gap where you have less coverage.

1) Yearly Deductible Phase

You may pay 100% of your medical costs until you hit your plan’s annual deductible — which can vary by plan.

2) Initial Coverage Phase

You pay a copay and/or coinsurance for each medication. If you and your plan spend a certain combined amount, you’ll reach the Initial Coverage Limit.

3) Coverage Gap Phase – “The Donut Hole”

The donut hole is closed, but if you surpass the Initial Coverage Limit, you enter phase 3. You’ll pay no more than 25% of the cost of your covered prescription drugs.

4) Catastrophic Coverage Phase

If you spend over $6,550 in 2021, you’ll enter phase 4. For the rest of the year, you’ll pay a small price for every prescription covered by your plan.

Notes: The coverage cycle resets on January 1 every year. Also, the dollar amounts for each phase can change from year to year.

If you or someone you know has a limited income, you may qualify for Extra Help and not know about it. The program, which is through Social Security, is worth about $5,000 per year, per person. It helps cover deductibles, drug plan premiums, and some copays. Your insurance agent can tell you if you qualify and help you enroll in this program.

Maybe you’re uninsured. Or maybe you have a high deductible or a high copay. No matter your situation, we can help you review your options and choose a plan that covers your prescriptions — so you improve your well-being and keep more money in your pocket. Contact Hale Health Benefits today!