Medicare Explained

Medicare is a health insurance program led by the federal government for people age 65 and older and those with certain disabilities and end-stage renal disease (ESRD). Our goal is to help you understand how Medicare works so you can get the right coverage for your situation.

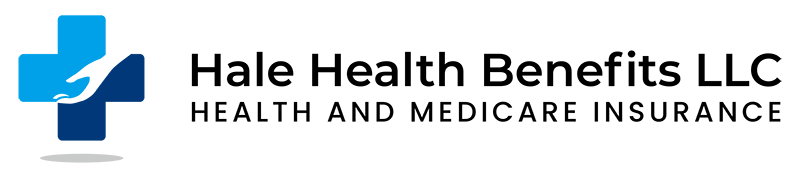

There are four parts to the Medicare program (see below).

Part A: The hospital insurance covers your care when you’re admitted to the hospital or skilled nursing facility. Most will NOT pay a premium for Part A.

Part B: The medical insurance covers your tests, doctor visits, and outpatient services. Most will pay a premium for Part B.

Part C: This is the Medicare Advantage program, another way to get your Part A and Part B benefits.

Part D: This is optional prescription drug coverage. Most will pay a Part D premium and are covered through a private insurer.

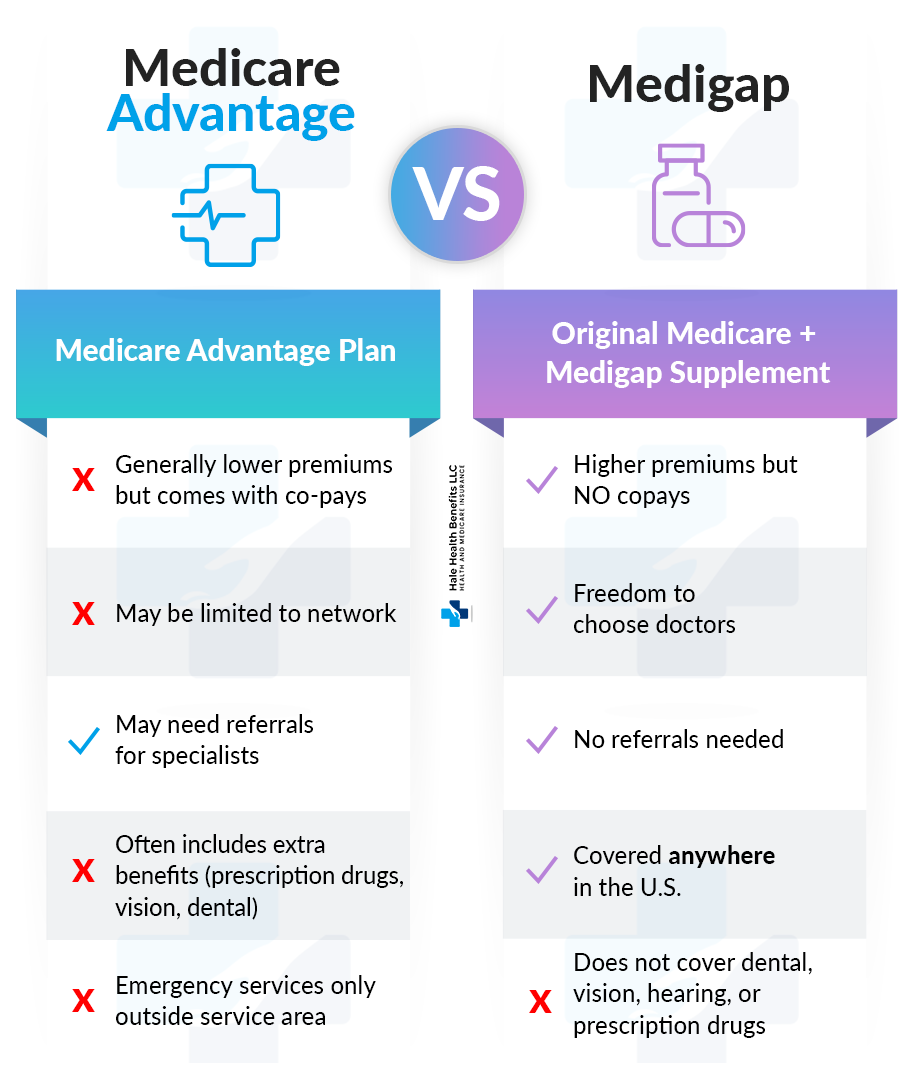

The next step is to decide how you’ll receive your coverage. There are two ways to get your Medicare benefits:

The first way is to stay on Original Medicare and add a separate Part D plan and a Medicare Supplement (Medigap) plan. Over 13 million seniors have chosen Medicare Supplement Insurance — that’s 1 out of every 3 Medicare beneficiaries. Doing so will help with the out-of-pocket costs of Parts A and B, such as deductibles and coinsurances.

The other way is to join a Medicare Advantage plan, which combines all your Medicare benefits into one card. Most Advantage plans include prescription drug (Part D) coverage.

Both options come with pros and cons. Several Medicare Advantage plans are HMOs, which means you have to get your care from within an approved network. Your choice of doctors, hospitals, and pharmacies could be limited.

On the flip side, your monthly premiums are typically lower and you have a financial safety net with an out-of-pocket maximum for Medicare Advantage plans. The two common types of networks are HMO and PPO.

Keeping Original Medicare and adding a Medigap plan will give you more flexibility for which doctors you can visit. You can use your plan wherever Original Medicare is accepted — a huge bonus if you travel or prefer to take control of your medical conditions.

Also, you may discover that the lowest premium plan is actually not the cheapest option for you in the long run.

Many people do not know the difference between Medicare and Medicaid. While both are a way of paying medical bills, they serve different demographics and have different costs.

Medicare has the same program nationwide and is designed for older adults.

Medicaid has programs that vary by state, which are for low-income individuals and families.

Some people qualify for both Medicare and Medicaid, known as dual-eligibles. For these folks, Medicare will be their primary insurance and Medicaid will be secondary.

Certain Medicare Advantage plans are available in Idaho counties where dual-eligibles can get their Medicare and Medicaid benefits, plus additional benefits like dental, hearing aids, and so on. These plans are called Dual-Eligible Special Needs Plans (D-SNP).

Before you enroll in a Medicare insurance plan, always ask how much it will pay for each of the following:

- Inpatient hospital care

- Doctor and specialist office visits

- Outpatient services and surgeries

- Durable medical equipment

- Medications

- Medical coverage while away from home

Enrolling in the right Medicare plan is an important decision for you to make. Make time for FREE advice from an independently licensed professional, like the ones at Hale Health Benefits. When you do, you can relax knowing we have you covered — and you’ll be well on your way to a seamless Medicare experience.